Maximize Your Benefits: Take Advantage of the HSA Contribution Limit Increase in 2024

In 2024, the IRS has upped the HSA contribution limits, offering an excellent opportunity to put more of your money to work for your physical and financial health. Let’s dive into what these changes mean for you and why maxing out your HSA is a wise choice for your budget and your peace of mind.

What’s new for 2024

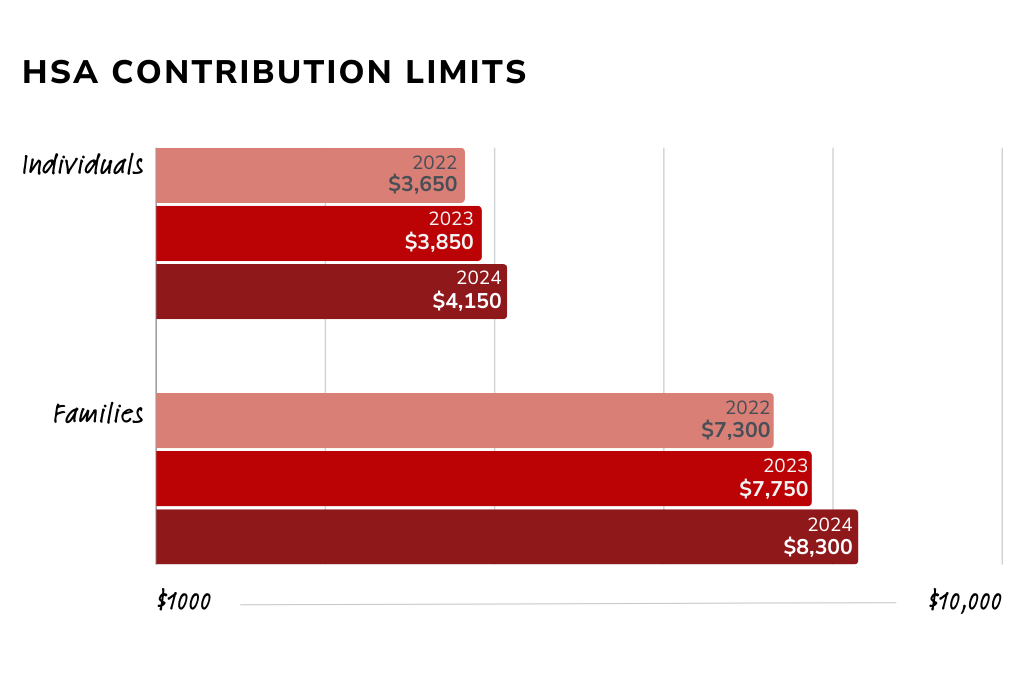

Under a qualifying high-deductible health plan, you may contribute a certain amount each year to your HSA. This year that amount is higher, and so is the minimum deductible for your plan to qualify as “high deductible.”

Individual Coverage

Can contribute up to $4,150 – up $300 from 2023

minimum deductible of $1,600 – up $100 from 2023

Family Coverage

Can contribute up to $8,300 – up $550 from 2023

minimum deductible of $3,200 – up $200 from 2023

What the new HSA contribution guidelines mean for you

Simply put, the limit increase provides you the opportunity to save more. By adjusting your contributions for 2024 to meet the new limit, you’ll maximize your tax savings as well as give yourself a little extra toward your future medical needs. As you can see above, the contribution limits tend to increase year over year, so don’t miss your chance to take advantage of every tax-free penny.

You should also take note that the qualifications for what counts as a “high deductible health plan” tend to change each year. So, you will want to check your health plan details to ensure your deductible meets the updated minimum for 2024.

Stay within the limit

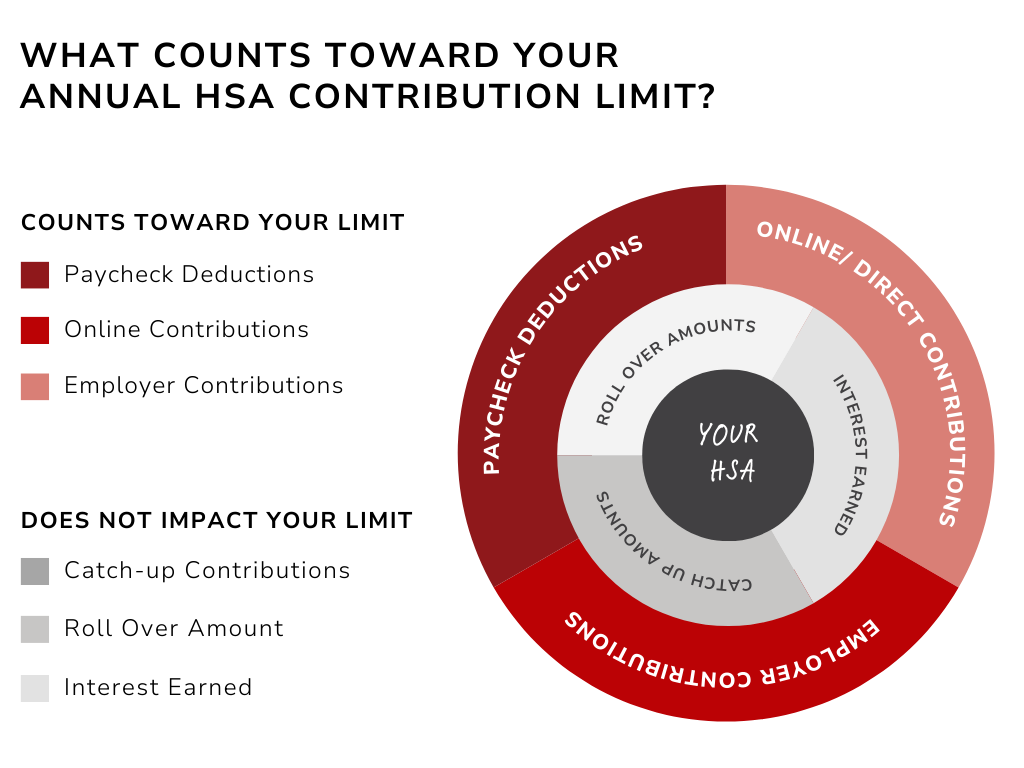

Though the limit is higher, you still need to keep in mind that exceeding the limit can result in IRS penalties. Keep tabs on your contributions, including any from your employer, to stay safe.

Mistakes happen, and if despite your best efforts you overshoot the limit, there is a way to fix it and avoid the IRS penalty. You can use an Excess Contribution and Deposit Correction Request Form from your HSA provider to set things straight.

Getting the most from 2023’s limit

Are you just now realizing that you could have contributed more in 2023? There is still time to hit the 2023 contribution limit of $3,850 (individuals) or $7,750 (families). In fact, HSA holders have until the April tax deadline to backfill their HSA. So, there’s still time to maximize last year’s savings.

Additionally, if you are 55 or older, you can contribute an additional “catch-up amount” of $1,000 each year. If you’re married, and your spouse is also over 55, they can open an HSA and add their own catch-up contributions.

Why maxing out matters

In a nutshell: the more you save, the more you save. Since your contributions are tax deductible, by maxing out your HSA you lower your taxable income. Additionally, the money in your account grows tax-free and any unused HSA funds roll over allowing you to build a nest egg for any future health needs or even retirement. Ultimately, a full HSA can mean a significant boost for your peace of mind; by maxing out your savings opportunity, you’ll know you’ve done your best to prepare for your future.

How to contribute

Contributing is easy, but we’ll review your options anyway. You can set up recurring contributions or send a lump sum a few times a year. However you choose to contribute, keep in mind that any money your employer may contribute also counts toward your contribution limit.

Payroll Deductions

Simply check with your employer about automatically deducting your contribution from your paycheck. This is typically the most convenient way to contribute since your employer can easily deduct the contribution before applying taxes.

Online Contributions

Contribute once or more regularly by setting up direct recurring contributions through your account. Contributing this way may lead to some extra work when you do your taxes.

Have questions? We are ready to help. Give us a call at 888-920-7526.

Contributing to your HSA is more than just a smart health move, it’s a savvy financial strategy. By leveraging new contribution limits, and staying informed, you can make the most of your HSA in 2024 and secure a healthier financial future.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2025 Planstin Administration - All Rights Reserved