What is Reference-Based Pricing, or RBP?

In a conventional health plan, providers set their rates and then negotiate discounts with insurance companies. This often creates uncertainty for employees regarding their healthcare costs, as prices can vary greatly between different providers.

In This Article

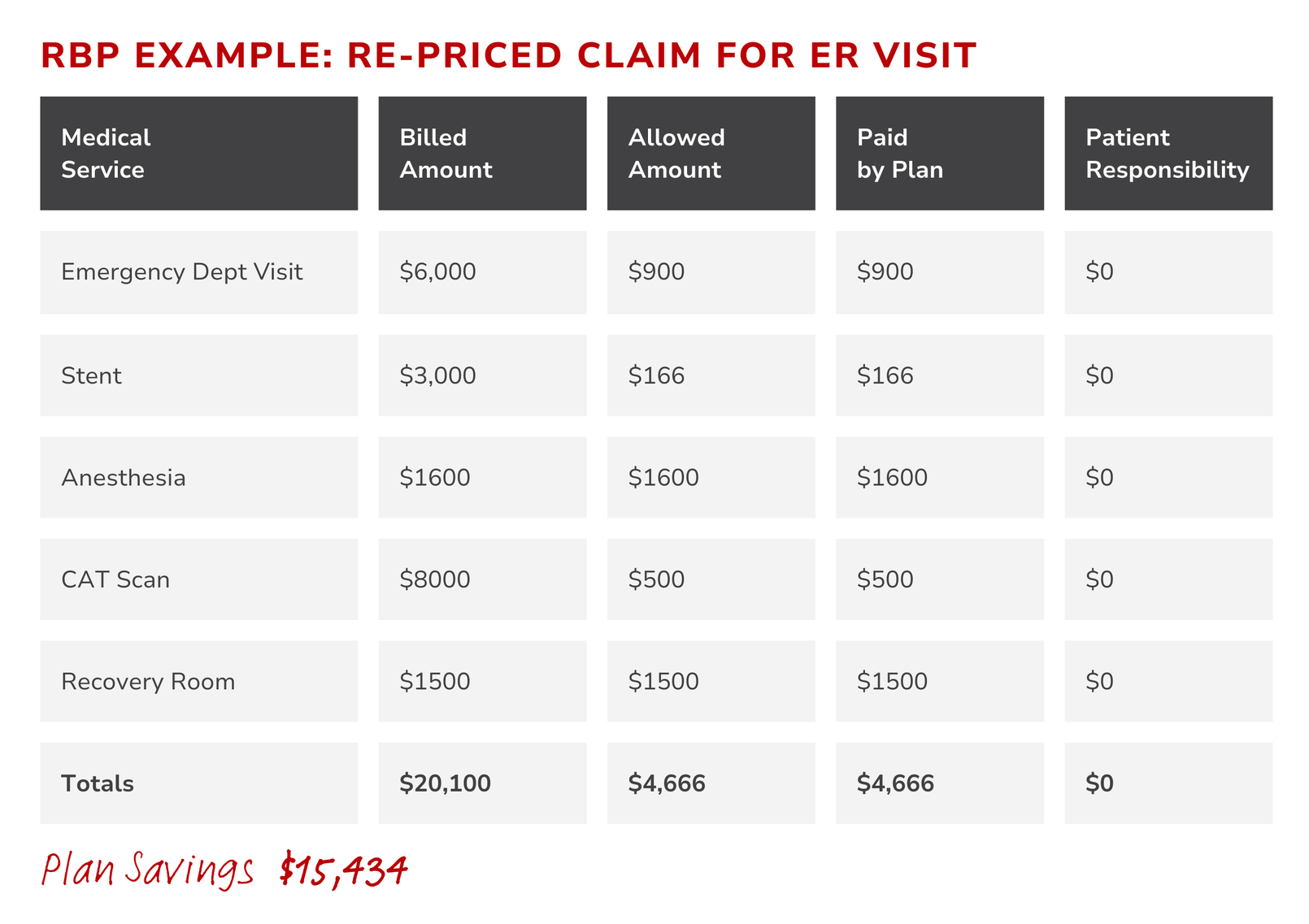

Reference-based pricing is an answer to the increasing cost of healthcare and unpredictable nature of provider pricing. In any given area, three providers offering the same service may charge three vastly different prices, leaving consumers and health plan sponsors at the mercy of over-inflated prices. In an attempt to contain these costs, reference-based pricing attempts to set a standard price for medical services, avoiding the uncertainty that often comes with medical billing, and encouraging providers to offer their services at a price closer to the reference point.

Key Insights

- RBP uses predefined reference rates rather than contracted provider networks.

- Employers can save on healthcare costs and reinvest in competitive salaries and a variety of benefits.

- Using predefined reference rates allows for price transparency and allows employees to make informed decisions.

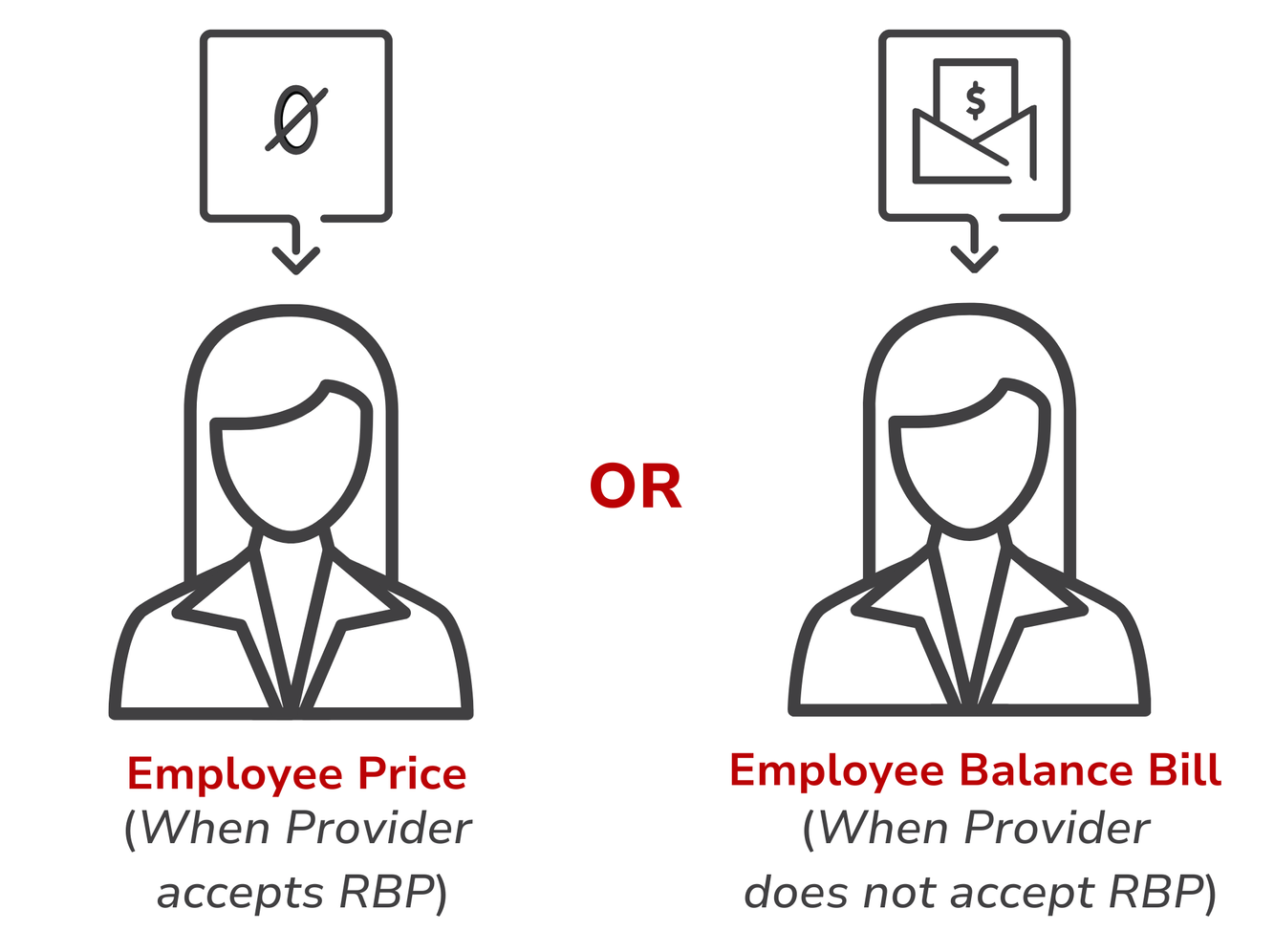

- Employees may be balance billed if they see a provider who does not accept RBP rates.

- Employers who use a TPA to manage their self-funded plan benefit from the advocacy and negotiation services the TPA will provide for employees.

- The more plans that use RBP rates, the more providers are encouraged to offer care in line with the reference price.

What is RBP?

Reference-based pricing is first and foremost a cost-containment strategy. This strategy is a key component in many employer-sponsored self-funded health plans. Why? Because RBP allows the employer to dictate how much they are willing to spend on a healthcare service.

Typically, healthcare costs are first determined by looking at the provider’s rate for a given service. Unfortunately, provider rates can vary greatly, making it difficult to assess the true cost of a service. By designing a plan that uses an RBP strategy, an employer can better predict and contain healthcare costs.

Why is RBP used?

Cost Savings

For employers, cost savings is built-in with an RBP methodology, and may be what enables a business to offer benefits for the first time. For those employers who have been offering benefits and paying inflated costs, using an RBP strategy provides savings that can turn into an opportunity to re-invest in their business.

Accessibility

When a health plan uses a network, not every employee will have ready access to an in-network provider. And out-of-network claims can come with high price tags for the employer and employee. Health plans with reference-based pricing eliminate the need for contracted networks, and make sure members have access to preventive services and other care near them.

Flexibility

Unlike the contracted provider networks that traditional health plans typically use, reference-based pricing eliminates in– and out-of-network distinctions and allows employees to choose any provider.

Who uses RBP?

Health plans that use a RBP strategy are often self-funded plans offered by employers working with third-party administrators. Employers chose to self-fund plans as opposed to purchasing insurance from a carrier often do so in an effort to better control healthcare costs and provide more flexibility. To contain costs even further, employers offering self-funded plans will design health plans with their TPA that use reference-based pricing. With their TPA managing the plan and providing negotiation and advocacy services, the employer can offer an effective health plan that respects their budget.

How does RBP work?

A health plan that uses a reference-based pricing methodology usually covers costs based on the Medicare rate plus a percentage for provider fees or a reasonable margin. To benefit from the reference-based price, employees must visit providers who accept the reference-based price as full payment.

If employees select a provider whose price matches or is below the reference price, they will only pay that amount. If they choose a provider with higher charges, they may have to pay the difference between the reference price and the provider's charge.

How Does RBP Benefit Employers?

By implementing RBP, employers can protect their health plan from excessive and unpredictable costs—an especially important consideration for self-funded health plans.

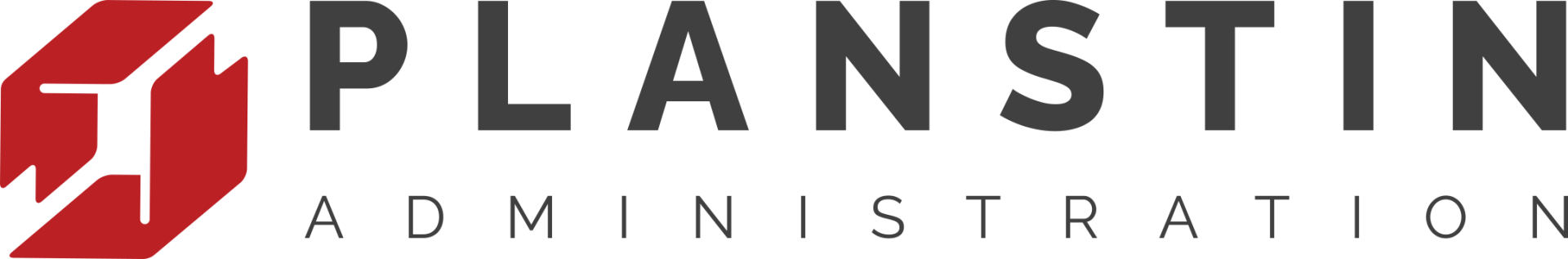

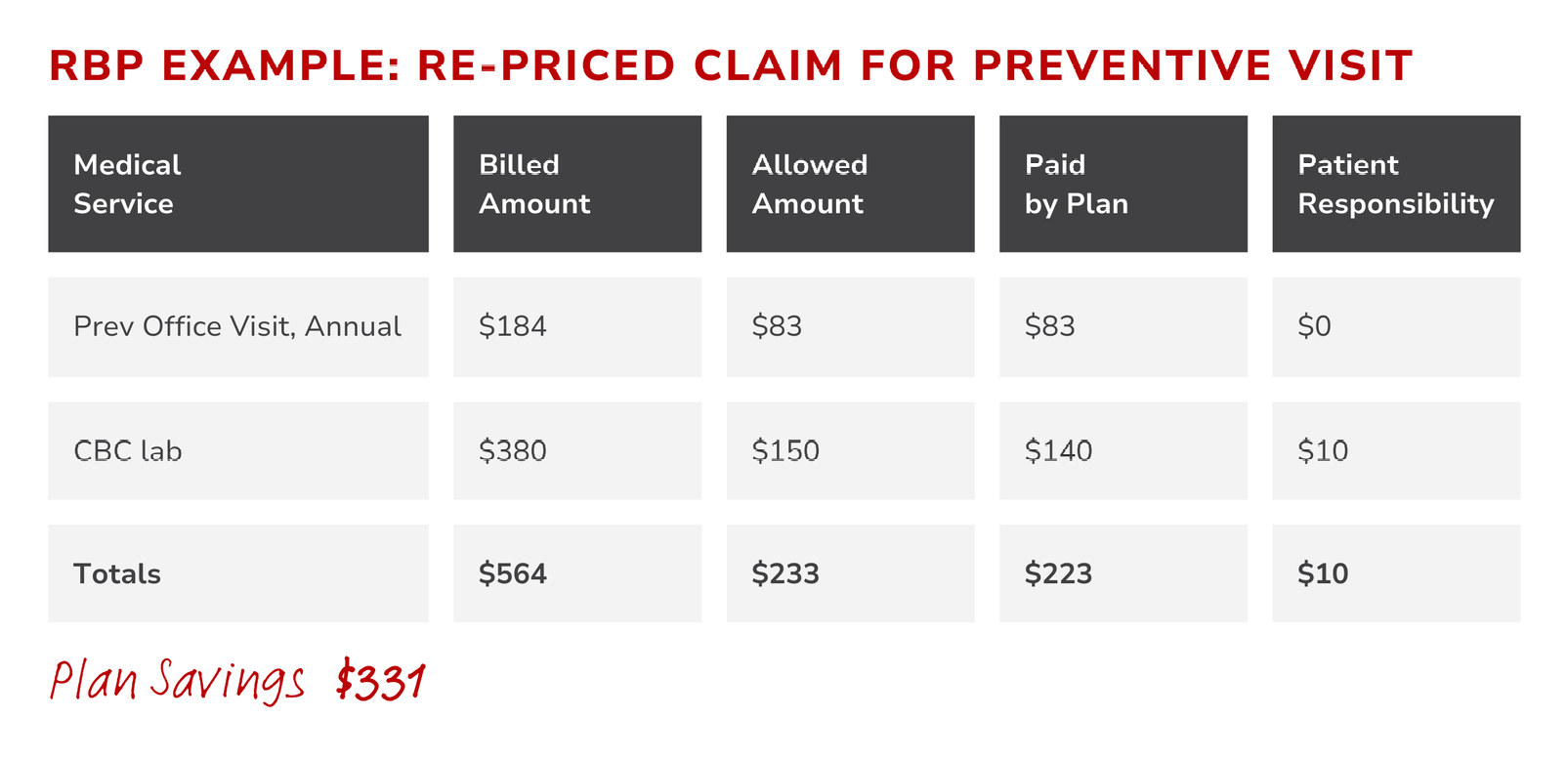

When an employer-sponsored health plan sets a maximum allowable amount based on a fair reference point, the employer avoids paying inflated charges from healthcare providers. The comparison shown here between billed charges and re-priced amounts demonstrates just how substantial the savings may be for the health plan.

By saving on healthcare expenses, employers can put more money into their business, including building a more robust workplace culture. Better benefits with the flexibility of RBP can lead to better retention rates and the ability to attract top talent.

How Does RBP Impact Employees?

From the start, employees will benefit from the lower monthly costs typically associated with RBP-driven health plans. While employees may benefit from the cost-savings of choosing a provider who accepts RBP rates, they still have the freedom to select any provider they choose. However, using any provider, regardless of whether they accept RBP rates, may result in balance billing. For instance, in the earlier RBP billing example, if the employee did not use a provider who accepted the plan’s allowed RBP amounts, they could see a significant balance bill.

Employees can get the most benefit from RBP if they are able to disconnect from the traditional, network-based approach of finding providers. This may mean a fundamental shift in how the employees shop for healthcare.

Ultimately, the more active role the employee takes in their healthcare decisions, the better RBP can work for them. Knowing this, employers who chose to use a health plan with RBP should prioritize employee education and make sure the TPA they work with to administer their plan offers advocacy services and negotiation support.

Dealing with balance billing

If employees are consistently seeing providers who do not accept RBP rates, they may consistently receive balance bills, which could lead to negative view of the employer-sponsored plan. How can employers overcome this, or avoid this altogether? The most important thing an employer can do is educate their employees about the plan and how RBP works. A capable TPA will support you in this effort, making sure you have the information you need to speak to your employees. The more the employees know, the better equipped they will be to get the most out of their benefits. When balance bills happen, your TPA may be able to negotiate on your employees’ behalf.

How does Planstin integrate RBP into plan designs?

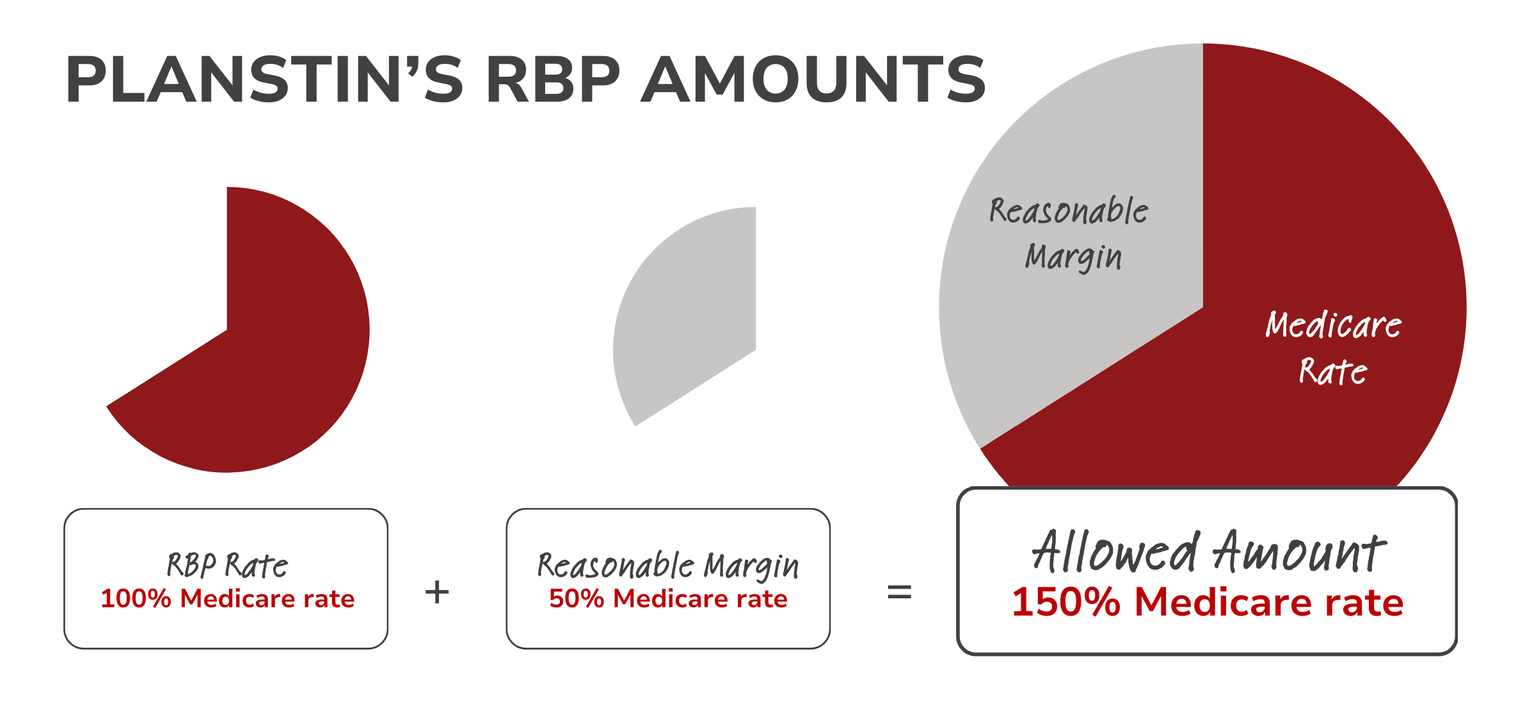

Third-party administrators like Planstin negotiate rates and pre-determine allowed amounts using reference points. Many RBP health plans use Medicare rates as a reference point because of their wide acceptance and standardized pricing. Planstin’s health plan designs also use Medicare rates as their primary pricing reference point.

As stated earlier, a RBP plan will take a reference point, add a reasonable margin (and possibly an additional percentage for facility or provider fees), and calculate the amount the plan will pay for a given service. With Planstin’s plan designs, the reference rate is 100% of the Medicare* rate, and the reasonable margin is 50% of the Medicare rate. In total, the allowed amount for any given service is 150% of the Medicare rate.

Occasionally, a Medicare rate may not be available for a service. If this happens, plans will pay a usual, customary, and reasonable (UCR) rate (generally a rate equal to the 75th percentile of charges billed by providers in your geographical area).

*Medicare pricing comes directly from the Centers for Medicare and Medicaid Services (CMS), using the current physician fee schedule, the clinical laboratory fee schedules, and other fee schedules offered directly from CMS.

RBP: Standardizing healthcare pricing

The traditional health plan pricing model based on contracted network rates can work well when employees are able to use in-network providers. However, out-of-network services often result in higher out of pocket expenses—or are completely excluded. Reference-based pricing (RBP) takes an alternative approach, generally stabilizing or reducing claim costs and potentially transforming the healthcare industry by setting standard prices for medical services.

Terms to Know

Balance bill – a bill sent from a provider to a patient for any extra cost owed when the provider’s rate is higher than the plan’s RBP rate.

Medicare Rate – the amount that Medicare will reimburse for a medical service.

Reference-based pricing (RBP) – an alternative healthcare pricing system that sets a standard price, or reference point, for medical services.

Self-funded plan – a type of health plan sponsored by an employer who pays employee healthcare claims directly (as opposed to purchasing insurance from a traditional carrier).

Usual, Customary, Reasonable (UCR)– A standard used to determine the fair price for a medical service in a specific geographic area.

Don't let traditional insurance options keep you from offering a small business health plan. Explore alternative benefits options that can unlock your business' potential.

For a closer look at how we can help your business create a benefits package that works for your team and your budget, click below.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2025 Planstin Administration - All Rights Reserved