I Am an ALE. What Does That Mean for My Business?

When your business meets the criteria for applicable large employers, you’ll find yourself in a whole new world of compliance considerations. From reporting requirements to potential tax penalties, ALE status can have a big impact on the day-to-day operations of your company.

In This Article

Has your business recently crossed the ALE threshold? Have you just discovered that your business is considered an applicable large employer? If so, you are likely trying to figure out what the implications of being an ALE are. By now you likely understand that being an ALE comes with specific responsibilities and strict consequences for avoiding or neglecting those responsibilities. So, you’ll want to be sure you know what your primary ALE responsibilities are and how you can effectively manage them.

Article Summary

As an applicable large employer (ALE), you are obligated to offer affordable health coverage to your full-time employees. To ensure compliance, accurately count your full-time employees, provide suitable coverage, and file the necessary IRS forms. This proactive approach will help you avoid tax penalties, maintain a positive reputation, and attract top talent.

Jump to ALE Responsibilities Jump to Tax Penalty Info

What is an ALE?

To recap our previous blog on this topic in simple terms, your ALE status is based on your workforce size. If you employ 50 or more full-time employees and equivalents, your business is an ALE.

For some, workforce size is easy to determine, but for many, finding out what their workforce size is in the eyes of the Affordable Care Act (ACA) is a bit more complex.

Fortunately, if you are unsure, help is available. Follow this link to find a simple ALE status calculator that can help you determine your workforce size. Additionally, if your situation is more complex, you can refer to our previous blog on this topic that includes helpful worksheets and more information about special employee types.

For now, let’s focus on what it means if you are an ALE.

Explore

Why does ALE status matter?

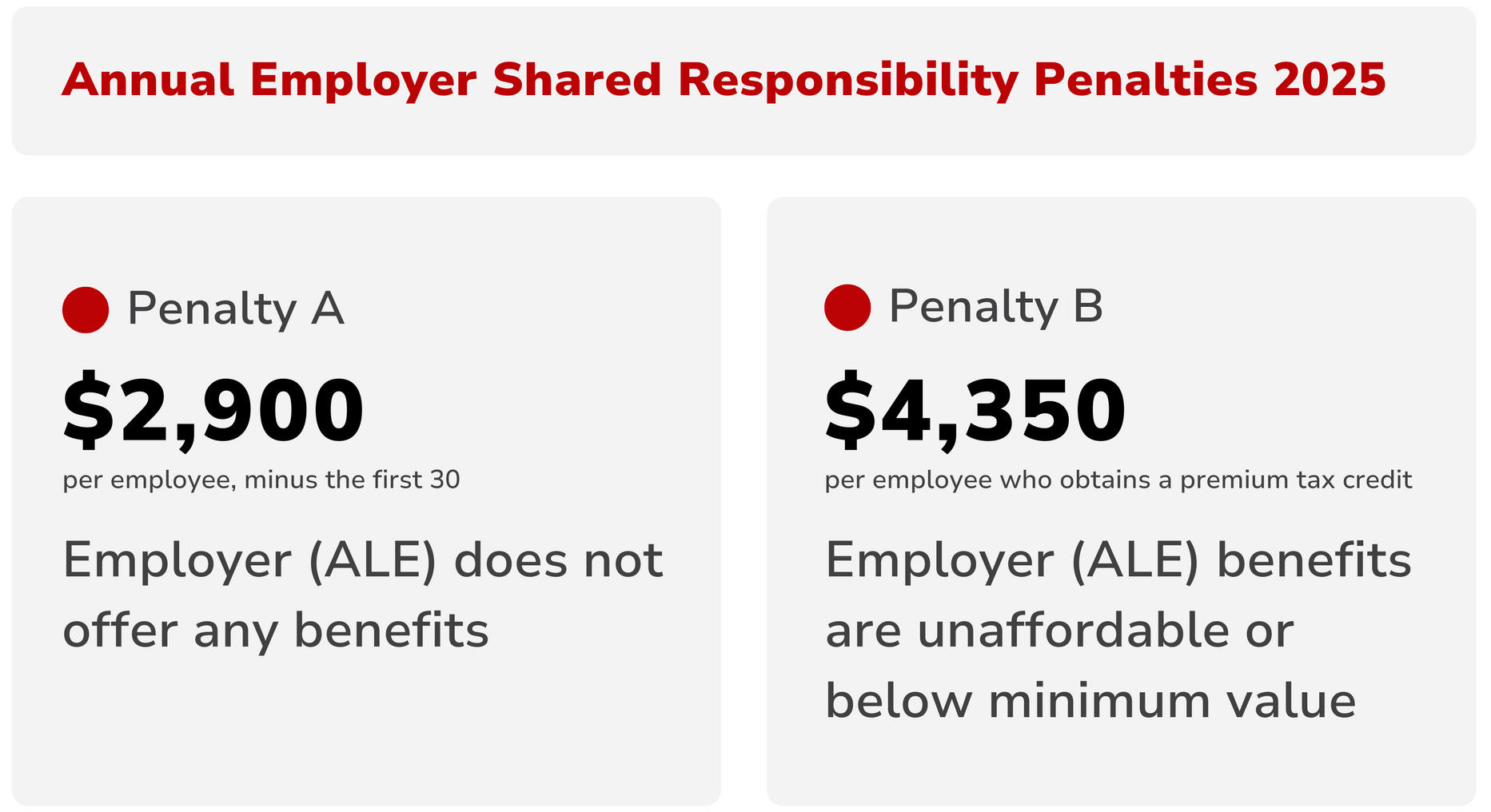

Being an ALE has significant implications for your business. For example, ALEs are subject to the ACA’s employer mandate which requires large employers to offer affordable healthcare coverage to their full-time employees or face a penalty. This penalty is referred to as the Employer Shared Responsibility Payment, and it is enforced by the IRS (IRC 4980H).

In short, if you are an ALE and you do nothing, you are putting your business at risk financially—not to mention risking your company’s reputation. Following through on your responsibilities as an ALE can save you money, keep you on the IRS’ good side, and even give you a competitive hiring edge. Not only do most employees prefer to get benefits through their employer, but also, most candidates won’t take a job with a company that doesn’t offer them.

Your responsibilities as an ALE

So, what do you need to do? First, if you are unsure of your ALE status, take a moment to verify that before you move forward. If you are sure, then prepare to give careful consideration to these three primary ALE obligations:

- Accurately count your full-time employee population.

- Offer healthcare coverage to your full-time employees.

- Report to the IRS.

Accurately count your full-time employee population

When you determined your ALE status, you calculated your workforce size using a combination of your full-time employees and the collective hours of your part-time workers. If you estimated, or for any other reason have any doubts about who your full-time employees are in the eyes of the ACA, you’ll want to spend some time ensuring you have accurate information.

Miscounting full-time employees or failing to identify employees who qualify as full-time could result in unintentional non-compliance. And whether non-compliance is intentional or not, you will still be liable for those hefty penalties. So, let’s look at some key information to keep in mind when assessing your full-time employee population.

Key points

- Full-time employees average 130 hours per month (ACA standards may differ from your company’s definition of “full time.”

- Count both hourly and salaried employees who work full-time hours

- Your full-time employee count matters for determining who you must make offers of coverage to and what your potential ESRP liability is.

- Part-time employee hours only matter when calculating full-time equivalents for determining your ALE status (they play no role in calculating your penalty liability)

How to Count Your Full-Time Employees

There are two primary ways to go about counting your full-time employees: the monthly measurement method and the lookback measurement method.

Monthly measurement method

The most straightforward method has you count employee hours each calendar month to determine who qualifies as full-time. Those working 130 hours or more per month on average (or 30+ hours per week on average) are your full-time employees.

Lookback measurement method

The lookback method is useful when you have variable-hour employees or seasonal employees who don’t follow a standard schedule. With this method you’ll average an employee’s hours over a set time period to determine their full-time status. Hint: seasonal workers relate to calculating workforce size while seasonal employees relate to counting full-time employees.

How To:

- Average an employee’s hours over the measurement period (3-12 months)

- Use a short administrative period (30-90 days) to finalize the employee’s full-time status and complete any work needed to make an offer of coverage.

- Consider the employee full-time for a stability period (3 months) after you make the coverage offer.

Getting an accurate full-time employee count is not only important to determine your ALE status, but also it’s key for fulfilling your next ALE responsibility, offering healthcare coverage to your full-time employees.

Offer healthcare coverage to full-time employees

Your core ALE responsibility is to offer health coverage to 95% of your full-time employees and their dependents.

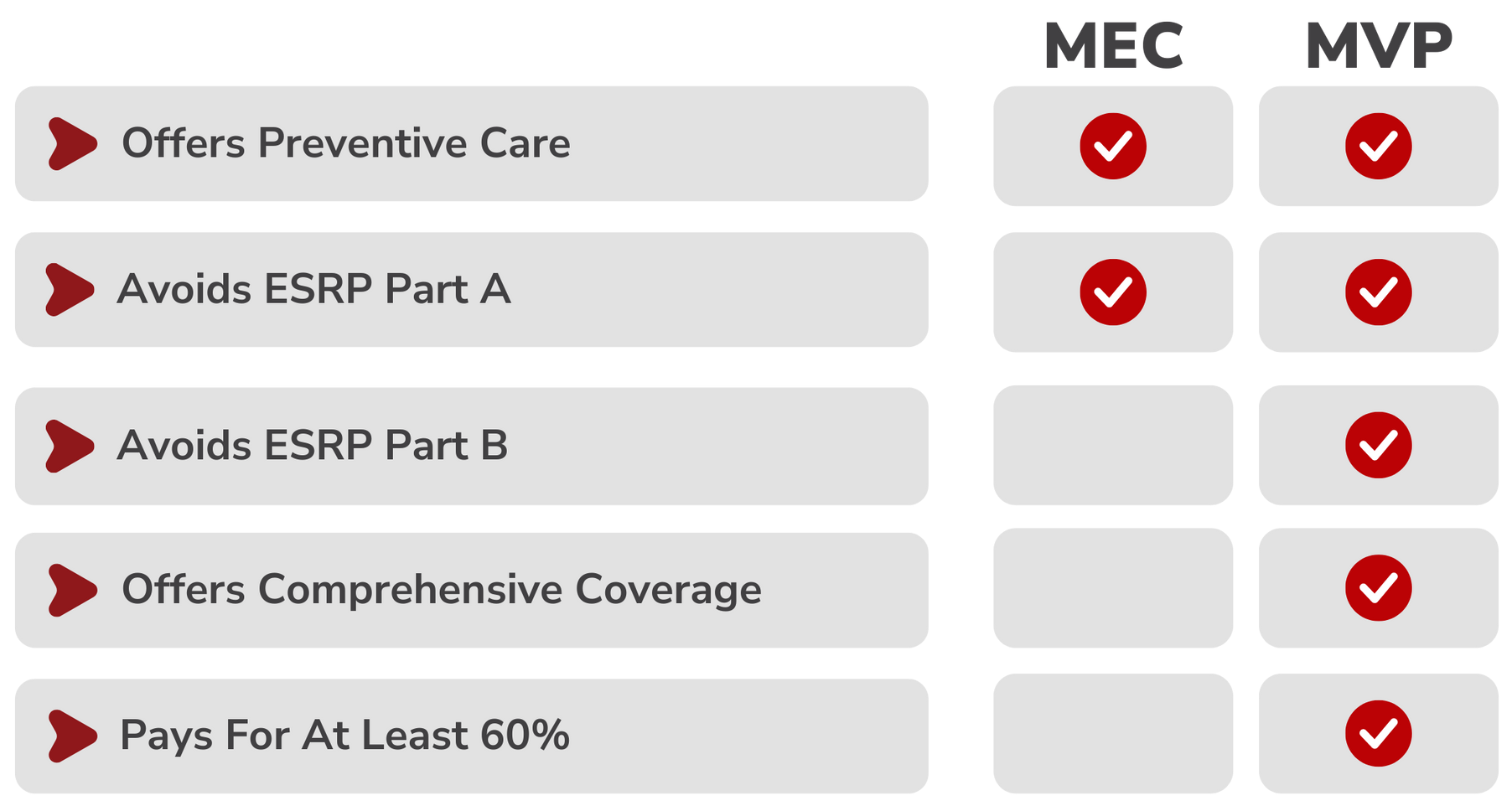

The ACA’s employer mandate requires that large employers must “offer minimum essential coverage that is affordable and that provides minimum value to their full-time employees (and their dependents).” The first part of this requirement focuses on simply offering something. You must offer what the ACA considers minimum essential coverage (MEC). The second part of the mandate focuses on the quality of that coverage when it is both “affordable” and meets “minimum value” standards.

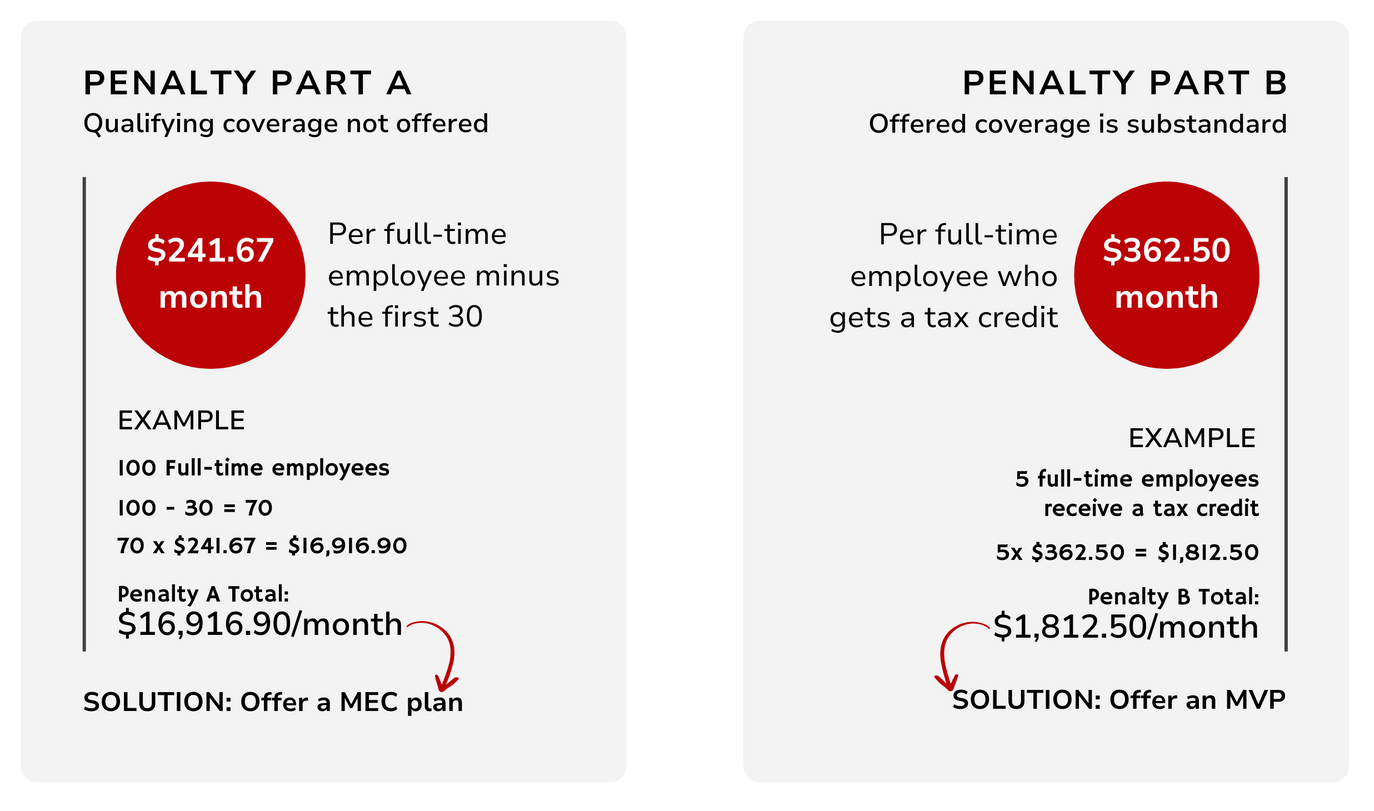

Enforcement of the employer mandate is similarly broken down into two parts. The ESRP is enforced by internal revenue code (IRC) section 4980H, which has an A and a B part. If you offer minimum essential coverage to your employees, you can avoid the first and weightier part of the penalty. By offering coverage that also meets value and affordability standards, you can avoid both parts of the penalty.

Key points

- The ACA requires large employers to offer healthcare coverage

- The IRS enforces this requirement with the 4980H Part A & B penalties

- Offering minimum essential coverage avoids Part A

- Offering a minimum value plan avoids Part A & B

- Minimum value means the health plan covers at least 60% of the total allowed medical expenses

- Affordable means the covered employee’s cost doesn’t exceed 9.02% of their income (2025)

Play or Pay

Obviously, many companies will want to avoid the risk of being penalized, but all employers must decide if offering ACA-compliant coverage is right for their situation. The idea behind employer shared responsibility is that employers contribute in some way to employee healthcare costs. So, whether employers chose to “play” by offering healthcare benefits, or just “pay” the tax penalty, they are sharing responsibility for employee healthcare.

However, your decision to play or pay should also consider factors like employee loyalty and the impact of employee turnover. Oftentimes offering benefits is the more affordable option between paying for healthcare benefits and paying to constantly recruit and hire new people.

Bottom line: as an ALE you can avoid being penalized by the IRS by offering your employees healthcare coverage. The better the coverage you offer, the lower your penalty liability will be and the higher your team’s morale will be. Whether or not you make offers of coverage, you have one more crucial ALE responsibility: telling the IRS if you offered coverage, and who you offered it to.

MEC vs. MVP: What's the Difference?

The primary differences between a minimum essential coverage (MEC) plan and a minimum value plan (MVP) are the extent of the coverage and the penalty for not offering one or the other.

Report to the IRS

Since ALE status and regulations are enforced by the IRS, you’ll need to report information to the IRS about how your business has or hasn’t complied with ACA guidelines. Like other things on this list of responsibilities, not doing it, or doing it wrong can result in penalties. For 2024, the penalties can range from $60 to $310 per return (IRC Sections 6721 and 6722).

So, what do you need to do? There are two main forms related to your ALE obligations that you’ll file together: Forms 1094-C and 1095-C.

File Forms 1095-C by March 31

You’ll file a 1095-C form for each full-time employee. This form details what health coverage, if any, you offered to the employee and if it met ACA standards. Basically, this form allows the IRS to verify that you have complied with the ACA’s employer shared responsibility provision—or if you owe a penalty.

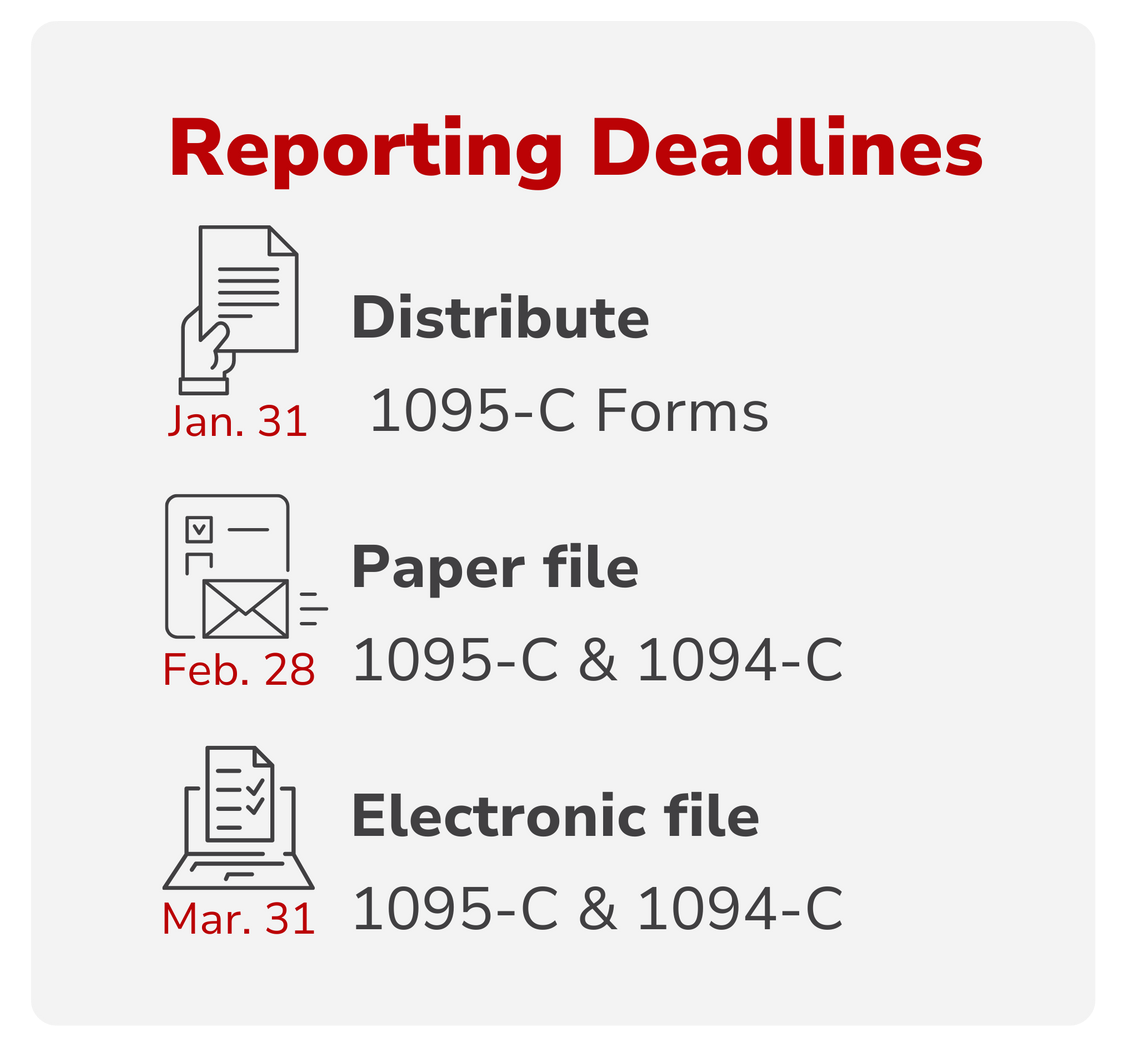

You’ll also provide a copy of this form to each employee by January 31st. Your employees use it to verify coverage, complete their tax returns, or possibly see if they qualify for a premium tax credit.

File Form 1094-C by March 31

You’ll file one 1094-C form as a cover sheet summarizing the 1095-C forms. This form provides an overview of your full-time employees and how many of them received offers of coverage. This form is meant to give the IRS a clear picture of whether or not you’ve complied with ACA requirements.

Reporting Tips

You can make the time-consuming process of reporting to the IRS much easier on yourself with a couple strategies. For example, you can integrate your reporting obligations with your payroll system. This way, you will get the most accurate data possible to inform your offers of coverage as well as reporting duties. Not only that, you’ll reduce the likelihood of errors in tracking hours worked and employee status—thus reducing your potential penalty risk.

Additionally, you can work with a benefits administrator who offers compliance support and will almost totally shoulder the burden of managing your reporting obligations. With an expert by your side, preparing and submitting your 1094-C and 1095-C forms will be nearly effortless.

Key points

- Form 1095-C is filed for each full-time employee

- Form 1094-C is an overview form filed with all the 1095-C forms

- Provide employees with 1095-C forms by January 31

- File 1095-C forms and 1094-C form by March 31 (electronic; February 28 paper).

- Integrate reporting with your payroll system

- Get expert compliance assistance from a benefits administrator

Adapting to your ALE status

Being an ALE might seem like a lot to handle, especially if this status is new to you. But with the right resources and a little professional help you can successfully navigate your ALE responsibilities with ease.

Remember, staying ACA-compliant isn’t just about meeting legal obligations and avoiding penalties; it’s also about demonstrating your commitment to your employees' well-being and creating a healthier workplace. So, take a proactive approach, seek expert advice if you need to, and enjoy the benefits of being a responsible ALE.

ALE Resources

Tools

- Determine your ALE status with Planstin’s simplified ALE calculator.

- Determine your ALE status and penalty liability with the robust IRS ESRP estimator.

Read More

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2025 Planstin Administration - All Rights Reserved